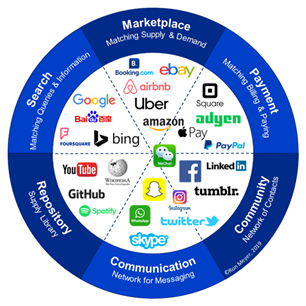

Op welke nieuwe manieren kan mijn organisatie inkomsten genereren? Ron Meyer ontwikkelde een inzichtelijke tool die je uitdaagt om anders te kijken naar managementvraagstukken: Revenue Model Framework

Alle organisaties hebben geld nodig om te kunnen functioneren. Ze moeten dus manieren hebben om voldoende inkomsten te genereren. Het verdienmodel van een organisatie is de wijze waarop zij haar inkomsten verwerft – de manier waarop de organisatie wordt betaald. Organisaties hanteren meestal impliciet de standaardaanpak dat inkomsten afkomstig zijn van de verkoop van producten of diensten aan klanten die de vraagprijs direct contant betalen. Toch zijn er naast dit ‘standaardverdienmodel' nog heel wat andere manieren om inkomsten te genereren.

5 dimensies van een verdienmodel

Het Revenue Model Framework beschrijft de 5 dimensies van een verdienmodel. Elke dimensie is geformuleerd als een vraag rond betaling, met daarbij 3 veelvoorkomende voorbeelden van alternatieven voor de standaardoptie. Alle 5 vragen moeten altijd beantwoord worden, maar er zijn in de praktijk meer mogelijkheden dan hier worden genoemd.

De kernelementen van een verdienmodel

De 5 dimensies van een verdienmodel die ingevuld moeten worden zijn:

1. WIE betaalt?

Van wie komt het geld? ‘De klant’ die betaalt kan iemand anders dan de eigenlijke gebruiker, bijv. de moeder van de gebruiker, de inkoopafdeling of de budgethouder. Als we nog verder kijken dan de feitelijke klant, kan het ook gaan om een:

adverteerder: die betaalt om iets anders te promoten;

sponsor: die betaalt om iets of iemand te ondersteunen;

verzekeraar: die betaalt om bepaald gedrag te stimuleren.

2. WAT wordt er betaald?

Is het voor de klant mogelijk om met iets anders te betalen dan met geld? Sinds de ruilhandel zijn we gewend om goederen om te wisselen voor iets anders dan munten. Typische alternatieven voor pecunia zijn onder andere:

data: betalen door het verstrekken van (persoonlijke) gegevens aan de leverancier;

activiteiten: betalen door (kleine) diensten uit te voeren voor de leverancier;

aandelen: betalen door een gedeelte van de toekomstige inkomstenstromen te geven.

3. WAARVOOR wordt betaald?

Wat ontvangt de klant in ruil voor betaling? Naast het betalen voor het daadwerkelijk ontvangen van het product of de dienst (pay-per-product), kunnen klanten ook betalen:

per gebruik: enkel betalen voor de feitelijke duur of intensiteit van het gebruik;

per resultaat: enkel betalen voor het resultaat dat bereikt is;

per add-on: enkel betalen voor de extra’s boven op het standaardproduct.

4. HOE wordt er betaald?

Op welke manier vindt de betaling plaats? De standaardsituatie betreft een simpele uitwisseling waarbij je als koper eigenaar wordt door het totaalbedrag direct volledig te betalen. Maar betaling kan ook door middel van een:

lease: betalen voor exclusief gebruik van een product gedurende een periode;

lening: betalen voor een product/dienst in termijnen gespreid over een periode;

abonnement: betalen voor herhaaldelijk ontvangst of toegang tot een product/dienst gedurende een bepaalde periode.

5. HOEVEEL wordt betaald?

Hoe is de prijs bepaald? De meest mensen weten wel dat de catalogusprijs slechts het eerste bod in een onderhandelingsproces is. Maar naast vaste prijzen en onderhandelingen kunnen tarieven ook worden bepaald door een:

veiling: een biedproces met meerdere partijen;

volumekorting: een prijs op basis van het aantal gekochte producten;

dynamische prijsstelling: een prijs op basis van vraag, beschikbaarheid, tijd en plaats.

De belangrijkste inzichten

Sterk standaard verdienmodel Organisaties houden vaak vast aan een standaard verdienmodel waarbij de toekomstige gebruiker meteen de vraagprijs moet betalen voor het product of de dienst. Dit model is zo standaard geworden, dat er zelden wordt nagedacht over alternatieve modellen.

De 5 dimensies van een verdienmodel Voor elk verdienmodel moet je antwoord kunnen geven op de vragen 'Wie betaalt?', 'Wat wordt er betaald?', 'Waarvoor wordt betaald?', 'Hoe wordt betaald?' en 'Hoeveel wordt betaald'. Het 'loont' om je te verdiepen in alternatieve antwoorden in plaats van altijd het standaard verdienmodel te blijven volgen.

Elke dimensie van het verdienmodel heeft diverse mogelijkheden Hier zijn slechts een paar bekende opties als voorbeeld gegeven.

Meerdere inkomstenbronnen nastreven Organisaties moeten zich niet beperken tot 1 optie per dimensie als zij hun verdienmodel ontwikkelen, maar betalers diverse opties bieden, zoals pay-per-use of pay-per-product. Daarnaast is het slim om meerdere inkomstenstromen na te streven door een verdienmodel per betalerscategorie te creëren.

Integraal onderdeel van het businessmodel Het creëren van een verdienmodel is geen losstaande activiteit maar maakt integraal deel uit van de ontwikkeling van een businessmodel voor de organisatie. Het is een strategische activiteit en niet een die overgelaten kan worden aan operationele besluitvormers.

Tip van Prof.dr. Ron Meyer

Verken alle mogelijkheden

De beste manier om de vanzelfsprekendheid van je huidige verdienmodel ter discussie te stellen is om jezelf (en je team) te dwingen om een optie te verzinnen voor alle 15 genoemde mogelijkheden. Gebruik de Revenue Model Framework om alternatieven bespreekbaar te maken.

Kickstart your thinking!

Als manager loop je voortdurend tegen allerlei complexe vraagstukken aan. Aan jou de taak om met een aanpak te komen en handelend op te treden.

Download het e-book Kickstart your Thinking van Prof.dr. Ron Meyer met 10 managementmodellen die je uitdagen om anders te kijken naar Strategie en Innovatie.

:quality(90))