Corporate Value Creation Model

How can my firm create extra value by being in two or more businesses? Ron Meyer presents an insightful tool to kickstart your thinking: Corporate Value Creation Model.

Key Definitions

A corporation is a firm consisting of two or more business units. Each business unit creates economic value-added for the corporation by producing and selling products and/or services in a particular market at a price higher than the cost per unit. If corporations only engaged in this standalone value creation, their overall value-added would be the sum of their parts.

Yet corporations also add extra costs to their business units by having at least one extra level of management. Therefore, they need extra corporate value creation over and above their standalone value creation activities to more than offset these additional corporate costs.

Conceptual Model

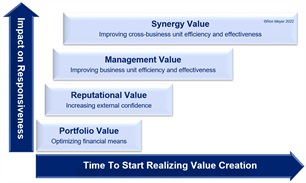

The Corporate Value Creation Model describes the four ways in which a corporation can create extra value, on top of what a business unit could have achieved on its own. Horizontally, the four value types differ in the length of time typically required to realize the intended value-added after launching or acquiring a new business. Vertically, they differ in how much they interfere with the business unit’s ability to quickly react in a tailored way to the specific demands in their market. This diminished responsiveness is in itself an additional corporate cost.

Download picture

Key Elements

The four types of corporate value creation are the following:

1. Portfolio Value. When a corporation acts like an investor, using financial engineering to add value to its portfolio of holdings, we speak of portfolio value. The metaphor here is ‘leveraging the family fortune’ – using the corporation’s money to make more money. Three common ways of creating portfolio value are:

a. Acquisitions/divestments. Buying businesses cheaply and selling them dearly.

b. Capital reallocation. Shifting cheaper internal capital between business units.

c. Tax optimization. Shifting tax burdens/advantages between business units.

All these forms of portfolio value creation can be achieved relatively quickly, with little interference in the day-to-day management of the business units.

2. Reputational Value. Often the fact that a business unit belongs to a particular corporation will bestow it with an air of reliability and/or attractiveness, which could help to win over external stakeholders. The metaphor here is ‘leveraging the family name’ – using the corporation’s reputation to gain competitive advantage. Three common forms are:

a. Buyer trust. Gaining customers’ confidence and hence a stronger bargaining position.

b. Partner trust. Gaining more confidence with suppliers, contractors and complementors.

c. Labor market desirability. Looking more appealing to prospective employees.

All these forms of reputational value require a bit of time for ‘advertising’ but can be realized relatively quickly. Business units only need to avoid damaging the corporate good name.

3. Management Value. Many business units, as ‘daughter companies’, can benefit by having a good ‘mother’, who can help with guidance, assistance, rules, and sometimes a stern hand. The metaphor here is ‘leveraging the family parents’ – letting the corporate center support and steer the ‘children’ depending on their level of development. This includes:

a. Management control. Interacting with business unit managers to direct their behavior.

b. Business unit staffing. Ensuring the right people are in the right positions.

c. Organizational systems. Installing the most appropriate processes and practices.

All this is also called parenting value or vertical value creation and takes a while to achieve. The extra coordination also limits the ability of the business units to be responsive.

4. Synergy Value. Many business units, as ‘daughter companies’, can also benefit by having good brothers and sisters, with whom they can share and get stronger. The metaphor here is ‘leveraging the family siblings’ – getting the children to work together as a team to save money or get better. The three most important types of synergies are: a. Sharing resources. Copying, reallocating or jointly using tangible and intangible means.

b. Integrating activities. Carrying out activities together or in coordination.

c. Aligning positions. Jointly approaching customers, suppliers, or other stakeholders.

All this is also called sibling value or horizontal value creation and can take a long time to grow. The high level of necessary coordination strongly restricts business responsiveness.

Key Insights

• Corporate value creation is essential. Most large firms consist of more than two business units, requiring more levels of management, bringing more cost and potential bureaucracy. They need to have a clear understanding of which value-added they are pursuing.

• Corporate value creation is possible in four ways. As a family of business units, corporations can leverage the family fortune (portfolio value), the family name (reputational value), the family parents (management value) and/or the family siblings (synergy value).

• Corporate value creation takes time. All four types of corporate value creation require an investment of time and energy before the full advantages can be realized. Many private equity investors therefore focus on portfolio, reputation, and a bit of management value.

• Corporate value creation comes at a cost. Management and synergy value look potentially attractive, but besides taking long to achieve, they also limit a business unit’s responsiveness, making them slower and less focused, while undermining ownership.

• Corporate value creation is overlooked. Despite its importance, few corporations have an explicit corporate level strategy in which they clarify which types of value are being pursued and how the negative impact on responsiveness will be limited.

Inspired by this kickstart?

During the six-day Masterclass Organizational Leadership you will work on solutions for a problem of your own definition, such as transforming with your organization and getting employees moving. You will also reflect on the performance of your Management Team and your organization. This will help you realize effective growth for your organization.

Read more about the Masterclass Organizational Leadership »

Corporate Value Creation Model is part 35 of a series of management models by prof. dr. Ron Meyer. Ron is managing director of the Center for Strategy & Leadership and publishes regularly on Center for Strategy & Leadership.