Last winter I enjoyed the Oranje (Orange) skating team. The Netherlands won skating medal after skating medal at the Olympic Games in Sochi. It didn't bother me that the mythical Elfstedentocht did not go through for the umpteenth time in a row. Eight gold medals, seven silver medals and nine bronze medals; truly something to raise your Duvel to. Even so, the Heineken House did not serve magic potions. What then can explain the Dutch skating team’s success? The natural Dutch passion for skating certainly played a role. But almost as important was the impressive skating infrastructure built in the Netherlands during recent years. You may ask yourself whether the Netherlands still has open living spaces available, when you consider the more than twenty skating rinks and the accompanying parking lots for skaters, supporters and 10,000 skating coaches[1]. The success of the Dutch skating sport can be explained just as easily as the success of the Flemish cyclo-cross. A population that loves the small sport in which the country invests heavily, a sport that is shown on television extremely often, along with lack of interest from the large countries.

Resources

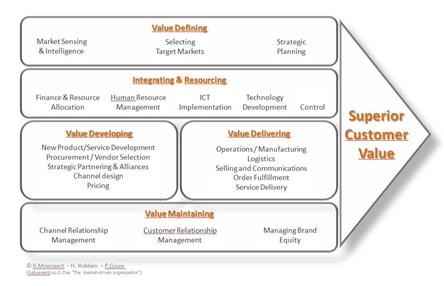

The acquirement of a winning value proposition for the client requires the input of organizational resources. These resources could be of a varying nature: they could be intangible (cultural) or extremely tangible (unique location), internal (financial) company resources or external resources (access to highly educated employees). This is the essence of theResource-Based Viewwhich has influenced (and renewed) the academic strategic school of thought dramatically since the start of the nineties. Bottom-line:there is nothing elitist about strategic marketing. Like John Rockefeller Jr. once said: doing ordinary things extraordinarily well. This is the basis of every success story. The same applies in top-notch cuisine. There is likely not one three-star chef who thought during the past month that he or she would win the Nobel Prize for Chemistry. But even the simplest things must keep on running extraordinarily well. René Redzepi, the opinionated wonder child heading the Danish Noma (Copenhagen), could certainly not have been proud of the fact that sixty restaurant guests became ill after contamination with the Noro virus. Literally encouraged by the absence of warm water for washing one's hands. Noro at Noma, this is not a Suske and Wiske album title, but an unpalatable alliteration concerning one of the best restaurants in the world. Which processes determine the difference between success and failure for you? The answer might come as a surprise.In our Competing in Changing Marketssurvey, we modified the value chain, as formulated by Prof. George Day (Wharton), to some extent[2] (for extra information on the survey, refer to foot note[3]). The survey participants were asked the following question: "How does your company score compared to the sector average for the core processes that are needed in order to develop, produce, deliver and commercialize your offer?"[4]

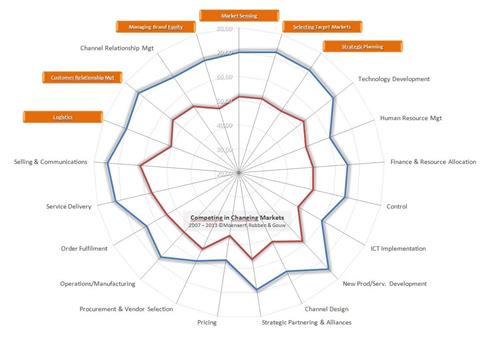

In the radar diagram we scaled the answer from an index of 0 (= much worse) to 100 (= much better). We distinguished between the successful and unsuccessful companies. The difference is most noticeable between the winners and losers for the following activities: brand management, strategic planning, logistics, target market selection, marketing intelligence and client relations management. Striking: logistics is therefore also part of the group (and was the most important factor in 2011!). Surprising, since the respondents are general and commercial directors.

In the radar diagram we scaled the answer from an index of 0 (= much worse) to 100 (= much better). We distinguished between the successful and unsuccessful companies. The difference is most noticeable between the winners and losers for the following activities: brand management, strategic planning, logistics, target market selection, marketing intelligence and client relations management. Striking: logistics is therefore also part of the group (and was the most important factor in 2011!). Surprising, since the respondents are general and commercial directors.

At least as important: one year later (2011), the activity with the lowest weighting factor was organizational price policy. We have been conducting this survey since 1999 (and standardized it online since 2007). Each time we asked for these core processes to be evaluated. For 21 activities the implementation of price policy scored the lowest of all core processes in 1999, 2003, 2007, 2009 and 2013 and second lowest in 2011[5]. Granted, the respondents’ answers were subjective. But nevertheless, this quite emphatically suggests a commercial pathology: interpretation of the only core process which brings money directly into the organization, consistently scores the very lowest based on the perception of those with the knowledge to make such distinction. Is pricing not a core marketing responsibility?

At least as important: one year later (2011), the activity with the lowest weighting factor was organizational price policy. We have been conducting this survey since 1999 (and standardized it online since 2007). Each time we asked for these core processes to be evaluated. For 21 activities the implementation of price policy scored the lowest of all core processes in 1999, 2003, 2007, 2009 and 2013 and second lowest in 2011[5]. Granted, the respondents’ answers were subjective. But nevertheless, this quite emphatically suggests a commercial pathology: interpretation of the only core process which brings money directly into the organization, consistently scores the very lowest based on the perception of those with the knowledge to make such distinction. Is pricing not a core marketing responsibility?

The Conductor’s Score

In the same survey we also asked the following question: "What are the five core processes in your company that require the most fundamental change in order to maintain or improve your competitive position in the next three to five years?"[6]When you are able to make five choices from a menu of 21 core processes, the standard expected value is 24%. Naturally the division in reality is entirely different. Throughout the years the top five remained almost unchanged: (1) product development, (2) client relations management, (3) strategic cooperation and alliances, (4) marketing intelligence, (5) sales and communication. Product development takes the lead: 54.5% of respondents indicated that product development is one of the five core processes in which the company must invest in order to maintain or improve its competitive position.

Do these top 5 also score similarly in your strategic plans? Most likely. But your competitors will likely also include these ingredients in their commercial kitchen. The crucial question then remains: how will you actually incorporate the innovation in these choices, in order to truly be different or better than your competitors? It is striking that the actual importance of logistics is not represented in marketing’s area of attention. As indicated already, in 2011 ‘logistics’ scored as the differentiating element between winning and losing. In that same year it occupied the very lowest position in terms of investment priorities! It is time for marketers to crawl out of their shell and once again fulfill their rightful role. The same also applies for pricing. The attention of many respondents, most with an executive status, is aimed at the usual suspects. I ask myself: is this because marketers don’t look beyond the severely obvious, or because other directors in the organization don’t want their sovereignty to be curtailed?

Do these top 5 also score similarly in your strategic plans? Most likely. But your competitors will likely also include these ingredients in their commercial kitchen. The crucial question then remains: how will you actually incorporate the innovation in these choices, in order to truly be different or better than your competitors? It is striking that the actual importance of logistics is not represented in marketing’s area of attention. As indicated already, in 2011 ‘logistics’ scored as the differentiating element between winning and losing. In that same year it occupied the very lowest position in terms of investment priorities! It is time for marketers to crawl out of their shell and once again fulfill their rightful role. The same also applies for pricing. The attention of many respondents, most with an executive status, is aimed at the usual suspects. I ask myself: is this because marketers don’t look beyond the severely obvious, or because other directors in the organization don’t want their sovereignty to be curtailed?

The Sovereignty of the CXOs

Marketers formulate the client value proposition and identify the facts that pertain to the overall organizational setup. Other competences and other departments, in particular, are addressed. One cannot pursue product leadership without product renewal. Operational excellence requires a transition to the work floor. And client intimacy is never successful without the required IT systems and the client-oriented employees. A number of companies evaluated this properly and marketing directs the necessary core processes on a sovereign basis. But for most companies, marketing does not get to be the conductor, not even the lead guitar player. It is often the docile vassal of the other positions. Just about every CXO takes precedence over the CMO.

If we aren’t careful, marketing will be reduced to merely thinking about the font and background color for the website. Communication in its most basic form. We already pointed this out before: we got ourselves into this situation. Marketers are, as often perceived, considered a residual category which links eloquent use of language to limited analytical insight, which knows how much a campaign costs but forgets how to calculate the cost price for the offer, and which can explain what anevent in brand buildingmeans but has absolutely no idea of the Return on Investment for the last online campaign. Let me repeat this once more. This might be the marketing group’s biggest problem. We are considered a creative department, but never an analytical department. And moreover, we are discounted as innovative, but very rarely considered necessary. Marketing must once again learn to make the difference. And we can!

[1] "Oranje sloopt de schaatssport" [English: Orange conquers the skating sport], De Standaard, 21 February 2014.

[2] Day G.S. The market-driven organization. New York, Free Press, 1999. We have replaced 'Applications engineering' and 'Customer inquiry handling' with 'ICT Implementation' and 'Logistics'

[3] Competing in Changing Markets was started by Rudy Moenaert and Henry Robben in 1999. In 2013 this survey was conducted for the sixth time (in cooperation with Peter Gouw). The comprehensive questionnaire - which was answered online from 2003 - asked the participants questions about the company's attributes, how the company competes, and how the company plans to compete in the future. A total of 1807 answers were received: 169 (1999), 260 (2003), 317 (2007), 365 (2009), 339 (2011), 357 (2013). The sample showed a distinction between the winners (scored 4 or higher on a five-point scale for profitability, client acquisition and client retention) and losers (scored 2 or lower on the same scale for profitability and had a score of 3 or lower for client acquisition or client retention). The winners made up 19.4% of the sample, the losers 11.5%. The questioning method was standardized in full starting in 2007, and we therefore report the findings from that point forward.

[4] Translated freely. The text was originally formulated as follows: "Looking at the different value creating activities that are needed to develop, produce, deliver and commercialize this product line, how does your company perform compared to the industry average?” The answer was given based on a five-point scale ('much worse' to 'much better').

[5] That year ICT implementation scored just a little lower.

[6] Translated freely. The text was originally formulated as follows: "Looking at the different value creating activities that are needed to define, develop, produce and commercialize this line-of-business, what are the five processes in your organization that require the most fundamental change in order to maintain or improve your competitive position in this industry in the next three to five years?”

:quality(90))