Risk Mitigation in Insurance

Local GAAP accounting produces large differences in revenues, operating income and equity which makes it impossible to compare financial statements of insurance companies across geographies. In fact, Hans Hoogervorst, the chairman of the International Accounting Standards Board (IASB), recently lamented the ‘accounting anarchy’ insurers now face.

However, while IFRS 17 will harmonize accounting practices, questions remain about the benefits (e.g., increased transparency) it will yield — as well as whether it is too complex to resolve the ‘anarchy.’

Premium revenue is one example of the accounting anarchy cited by the IASB. Currently, premium revenue is often recognized on cash basis, but the IASB believes it should be recognized proportional to the service provided — i.e., the insurance coverage. For example, the upfront single premium for a 10-year coverage should be recognized at 10% rather than at 100%, as is the case with recognition on a cash basis.

The underlying principle of the IFRS 17 standard is that the current value of a contract should be measured. This current value depends on best estimates of all future cash flows. Under IFRS 17, the prospective cash flows of existing contracts are remeasured annually, and the valuation is adjusted according to the impact of changes of the best estimates.

If estimates are not adjusted, profitability is released according to plan. However, if the estimates are updated, the valuation impact of the changes is reflected in the future underwriting result.

IFRS 17 aims at profit recognition based on the proportional allocation of value captured in future cash flows. To achieve this, the standard works with the help of four so-called building blocks:

- Future cash flows: the estimated future cash inflows (premium) and cash outflows (claims and costs);

- Discounting: the methodology of converting future dollars to current dollars (or whatever currency unit used), combined with the discount curve that is used;

- Risk adjustment: the cost of capital that is needed to sustain higher than predicted claims and costs; and

- Contractual service margin (CSM): a reserve for future earnings that is released during the lifetime of the insurance contract.

Below, these four building blocks are applied to an insurance contract, distinguishing between a new contract and the remeasurement of an existing contract.

The New Contract

Let’s begin by using an example based on an IASB paper for an insurance contract with 5-year coverage; an annual premium of $200 (paid end of year); and annual (estimated) claims and costs of $100. In this first example, we’ll neglect discounting and the risk adjustment.

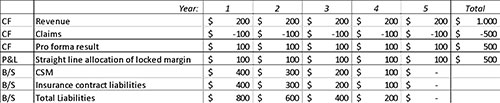

Estimated cash flows, profitability, CSM and total liabilities develop as follows:

Table 1: IFRS 17 Example — New Contract, No Discounting and No Risk Adjustment

Based on the estimated cash flows, the yearly “pro forma” result is calculated. The sum of the yearly pro forma results is then (linearly) allocated to each year.

The impact on the balance sheet is shown in the lowest block. First-year CSM is $500, from which $100 is immediately released. The CSM is further released at the end of each year, and is empty after year five.

Insurance contract liabilities equal the present value of the future claims (and costs), so they start at $500 — but are decreased by $100 at the end of the first year. CSM is on the liabilities side of the balance sheet, and we therefore calculate the total liabilities by adding the CSM and the insurance contract liabilities.

As a side step, let’s now illustrate what the situation looks like with a single-premium contract:

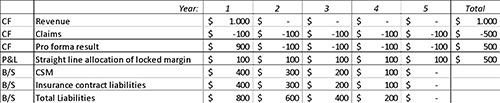

Table 2: IFRS 17 Example — New Contract, No discounting, No Risk Adjustment and Single Premium

Note how the timing difference of the premiums impacts the cash flows but also changes neither the P&L nor the B/S. This is how IFRS 17 puts an end to one of the root causes of accounting anarchy. Premiums and acquisition costs (which, by definition, cluster at the inception of the contract) are both automatically spread out across the coverage period.

Separate blocks for cash flows, P&L and B/S are also presented in Table 2. This is important because, according to IFRS 17, the P&L and B/S blocks must be “shielded” from irregularities in the cash flow blocks if the insurance service is equally provided for each year of coverage.

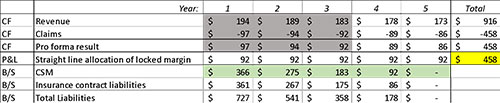

Below (see Table 3), we go back to the original IASB (yearly premium) example and add discounting. The discount curve is assumed to be flat at 3%, and the amounts reported are measured as dollars at the start of year one (meaning that the future cash flows are discounted and translated to the equivalent of dollars at the time of the inception of the contract).

Table 3: IFRS 17 Example — New Contract, Discounting and No Risk Adjustment*

*Discounting in the table is based on a flat discount curve of 3%, and the dollar amounts are discounted to dollar equivalents at the start of the contract.

Color codes are added to the table to facilitate reconciliation with analyses presented below.

The impact of discounting is clearly visible in the table. The $200 premium and $-100 claim amounts are progressively worth less in terms of current dollars (at the time of the inception of the contract). What’s more, the straight-line allocation of locked margin ends each year (year one through year five) as the same amount ($92) in this example. Of course, the recognized P&L amounts will be higher because of the reversal of the discounting, as demonstrated below.

At the end of year four, the CSM balance is $92, which is exactly the amount needed to cover year five and the last margin of the contract that is released from CSM to P&L.

In the remaining examples in this article, we will not focus on the risk adjustment. If a cost-of-capital approach is applied and the assumed shocks are a fixed percentage of the claims and costs — and if the cost-of-capital is fixed — the risk adjustment works as a simple multiplier on the claims and costs. If, e.g., a 10% shock is assumed and the cost-of-capital is 5%, the multiplier to be applied to yearly claims and costs would be 1.005.

The Existing Contract: Time Shift without Changes to the Best Estimates

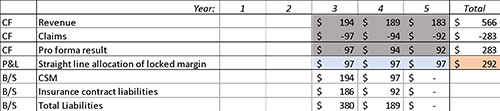

Nothing unexpected happens in the IASB example in years one and two. Consequently, if the expectations for years three, four and five remain unchanged, we can accurately calculate (in end-of-year-2 dollars) data for revenues, claims, P&L, CSM and insurance contract liabilities.

Table 4: IFRS 17 Example — Existing Contract with Discounting* and No Risk Adjustment

*Discounting in the table is based on a flat discount curve of 3%, and the dollar amounts were calculated as end-of-year-2 dollars.

Note that, with respect to the cash flow block of the table, this scenario is only a time shift. Since end-of-year-2 dollars for years three, four and five are presented, the discount factors for t = 1, 2, 3 equal (1+0.03)-t.

As we can see, the pro forma result deviates from the straight-line allocation of locked margin. That’s because, in discounted dollars, the pro forma result declines in time. The discounted allocated result is kept the same, since it is the same coverage that is provided each year.

For the same reason, the sum of the pro forma result ($283) deviates from the straight-line allocation result ($292), even if expected nominal cash flows have not changed. This also means that, for an existing contract (after time shifting), the CSM is not the present value of future pro forma result. Rather, it is a reserve that has been established at the inception of the contract for the future release of profit amounts whose present values are the same.

In end-of-year-2 dollars, the CSM equals $292 for the payment of three locked-in margin amounts of $97 each. The allocated profit of $97 (in end-of-year-2 dollars) is equal to the margin of $92 (see table 3) multiplied by 1.032 for the time shift toward end-of-year-2 dollars.

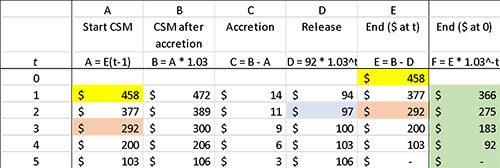

The CSM is therefore established in a forward-looking way: i.e., the reserve ($292) is for three future releases of $97 of allocated profit. After year three, only $194 is left, as shown in table 4. The forward-looking CSM can also be calculated by first establishing the future nominal releases (using the locked-in margin of 3%, as in column D of table 5) and then discounting and summing up the amounts.

Forward-looking CSM can be squared with backwards-looking CSM. The CSM in a given year is equal to the year-on-year “accretion” (the growth of the CSM with the discount rate) minus the paid-out allocated profit.

It is helpful to think of the CSM as a liability with a fixed-term interest rate equal to the discount curve. Each year, the CSM is accreted to reflect the time value of money. The addition is posted as an interest expense in the investment result component of the P&L.

Table 5: Squaring Forward-Looking CSM with Backwards-Looking CSM

Color codes have again been added (to Table 5) to facilitate reconciliation with amounts in the previous tables. Column E reflects the CSM at the end of year (t), and the last column reflects the value of the CSM as measured in dollars at the inception of the contract.

The Existing Contract: Remeasurement

For the remeasurement, we distinguish between a change of the best estimate of future cash flows and an adjustment of the discount curve.

Best Estimate of Future Cash Flow Changes

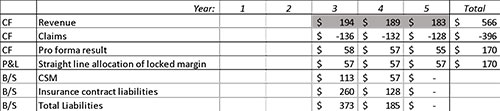

In the IASB paper, the estimated claims change after two years. The undiscounted cash flows decrease from $-100 to $-140 for years three, four and five.

Table 6: IFRS 17 Example — *Estimated Cash Flows for Years 3, 4 and 5

*The data in this table is based on an existing contract with discounting (flat 3% curve), no risk adjustment and end-of-year-2 dollars.

The increase in claims is reflected in a lower margin for the remaining three years of the contract. From year-three forward, the adjusted margin of $57 is recognized (prospectively) in the P&L. Due to the recalibration of the CSM, the sum of the pro forma results and the sum of the straight-line allocated margins are, again, the same.

At the end of year two, the CSM needs to decrease from $292 (see tables 4 and 5) to $170 (the sum of pro forma results in table 6 in end-of-year-2 dollars). This amounts to a vaporization of $122 of contract value. Meanwhile, the insurance contract liabilities increase by (roughly) the same amount; the total liabilities ($373 in table 6 vs. $380 in table 4) barely change; and current P&L is not impacted.

Adjustment of Discount Curve

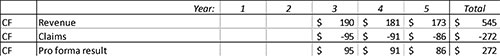

A change of the discount curve receives a different treatment. As depicted in table 7 (below), given the timing of the cash flows, an increase of the discount curve leads to a decrease of the contract value.

Table 7: IFRS 17 Example — Existing Contract with *Discounting (Flat 5% Curve) and No Risk Adjustment

*The flat 5% discounting curve starts in year three, and the dollar amounts in the table are listed in end-of-year-2 dollars.

In this case, the estimated future profitability of the contract turns out to be only $272 (in end-of-year-2 dollars) instead of the previously calculated (and disclosed) $292 (table 4). The value loss of $20 is reported as a loss in “other comprehensive income,” per IASB guidelines.

For the accretion of the CSM, the discount rate is not changed, since it is “locked” in the initial CSM. Consequently, the unwinding of the discounting of the CSM is done with the help of the original discount rate. This is in line with the view that the CSM is treated in the same way as a depositor with a fixed (locked-in) interest rate.

Relating CSM to P&L

Under IFRS 17, P&L is broken down into an underwriting result and an investment result. The underwriting result is equal to the release of the CSM that was planned at the inception of the contract. Higher (lower) realized premiums and lower (higher) realized claims (and costs) than expected have a favorable (unfavorable) impact on the underwriting result.

If the estimates of the future cash flows change, the CSM is changed. Higher (lower) expected claims lead to a lower CSM and equally higher (lower) Insurance contract liabilities. The underwriting result is not immediately impacted. P&L, meanwhile, is only effected if the CSM would otherwise be negative. (In such a scenario, the contract would be considered “onerous.”)

Moreover, the future releases from CSM will be lower (higher) after the adjustment, so higher (lower) expected future claims do impact the future underwriting result. Current P&L is not impacted.

The investment result equals the investment income of the assets minus the interest expenses. The reverse discounting of CSM and insurance contract liabilities are both interest expenses.

More Transparent?

An easy criticism is that IFRS 17 will make the B/S and profitability more volatile. The big question, though, is more volatile than what? If we compare the straight-line allocation of future profits to cash-based practices (see the pro forma result in table 2), then IFRS 17 is actually less volatile than current P&L accounting practices for insurance.

Under IFRS 17, changes in estimates are absorbed by shifting the expected future value gain/loss between CSM and insurance contract liabilities (see tables 4 and 6). Current P&L is therefore shielded from this change. However, it is also true that changes in the discount rate will occur often under the new accounting standard. So it’s likely that other comprehensive income — which will need to be reported as “OCI” under IFRS 17 — will actually be more volatile.

Regarding comparability and transparency, one can wonder whether these principles will indeed be served by such a complex standard. Much of the external reporting will depend on best estimates, and the modeling approaches behind these estimates will be, to a large extent, firm-specific. So it remains to be seen whether IFRS 17 will increase comparability and transparency.

Since P&L is protected against changes in the discount curve under IFRS 17, there will also be no direct connection between the management of interest rate risk and P&L. This seems to suggest that changes in discount curve are beyond the control of the insurer. However, this is actually not the case, because these risks can be (and should be) managed by matching asset and liability cash flows.

Master in Finance (MIF)

Our Master in Finance program provides you with broad financial expertise and knowledge. It will help you acquire the analytical tools and skills needed to make sound financial judgments. Become a financial heavyweight, strategically adept at plotting a sustainable, socially responsible course for a healthy and prosperous company future.

Read more about this Master