Buy American, Hire American: The Sovereign Debt Dilemma

While President Trump’s protectionist trade policy has been debated and criticized, home bias is already pervasive in the financial community. Indeed, stress tests performed by the EIOPA highlight an overwhelming home country bias toward holdings of sovereign debt.

'Buy American, Hire American' is one of the most quoted phrases from President Donald Trump’s inauguration speech. It refers to a protectionist policy aimed at preserving manufacturing jobs in the US.

There is already much debate about that policy (as well as the efficacy of accompanying measures, such as the border tax), but criticism of a protectionist approach actually dates back centuries. In fact, the comparative advantage theory outlining the benefits of international trade and the distortions of protectionist measures can be traced back to classical economist David Ricardo (1772-1823) and his groundbreaking example of beneficial trade between Portugal and England.

In Ricardo’s example, although Portugal could produce both cloth and wine more efficiently than England, it still made more sense for Portugal and England to trade, because both countries would benefit from trading those commodities. Since that time, the insight that international trade is not a zero-sum game has been generally accepted by economists (but not by politicians).

More recently, Nobel laureate Paul Krugman has denied that a border tax (such as the tax recently proposed by Trump) would provide any competitive advantage to the US. Nonetheless, it is clear that home bias will be the cornerstone of US economic and foreign policy for some time to come.

Home Bias in the Financial World

Although home bias can be criticized, it is already pervasive in the financial world. A July 2015 article authored by leading economists pointed out that there is overwhelming evidence for sovereign debt home bias among large European banks. This home bias, the authors noted, occurs both on a voluntary and involuntary basis.

The voluntary investment in local sovereign debt derives from the idea that it is ultra-safe — i.e., it can only hurt banks if the government fails, in which case the banks would likely fail anyway. Involuntary investment in local government debt, on the other hand, is often spurred by regulatory or supervisory pressure on banks to invest locally. We’ve seen much of that pressure in Greece, for example, where banks have bought up huge amounts of government debt.

Of course, there is also a more obvious reason for home bias of sovereign debt holdings within banks: portfolio managers have a much better understanding of local sovereign debt issued by a government they read about daily in their newspapers. This “information bias” can very well lead up to the home bias in their holdings.

Recent Stress Testing Evidence

The best evidence pointing into the direction of home bias in the financial world comes from the recent stress test conducted among European insurance companies by the EIOPA. When it issued the results of that test, for the insurance companies in each of its participating countries, the EIOPA reported the distribution of European insurers’ holdings of sovereign debt across countries.

The participating insurers have a total asset portfolio of EUR €6.3 trillion — almost half of which is invested in bonds (47%). Since half of the bond portfolio is comprised of government bonds (the other half being corporate bonds, including collateralized assets and structured notes), the insurers’ sovereign holdings total €1.5 trillion.

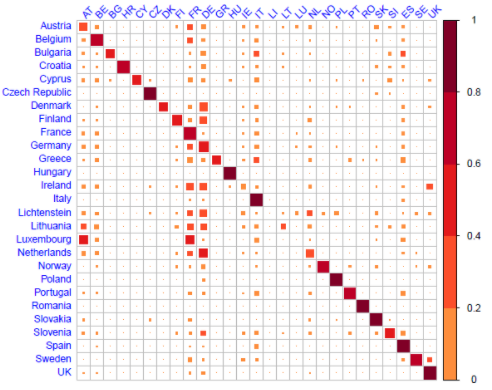

Figure: Distribution of the Sovereign Debt Portfolio of Participating Countries in the EIOPA Stress Test for Insurers

*Source: EIOPA

In the matrix above, the data on each row adds up to 100%. The larger and more red the square, the larger the share of investment in the sovereign bonds issued by the country designated in the column label.

As we can see, the level of home bias is overwhelming. The main diagonal of the matrix stands out as a pervasive anchor point for the sovereign debt holdings of almost all countries included in EIOPA’s stress test. Half of the countries have 60% or more of their sovereign holdings in their home country.

Since most of the countries are part of 19-country Eurozone, currency risk is not a reason for this outright home bias. However, information bias and pressure (at least in some cases) might be the largest drivers for the home bias.

Parting Thoughts

Although every financial risk manager knows the benefits of diversification, there is overwhelming evidence of home bias of financial holdings. The strongest recent evidence was supplied by the EIOPA stress test for insurers’ sovereign holdings.

Master in Finance (MIF)

Our Master in Finance program provides you with broad financial expertise and knowledge. It will help you acquire the analytical tools and skills needed to make sound financial judgments. Become a financial heavyweight, strategically adept at plotting a sustainable, socially responsible course for a healthy and prosperous company future.

Read more about this Master