On May 12, the 2020 results of the Sustainable Brand Index™ for the Netherlands were presented (SB Index, 2020).

The Sustainable Brand (SB) Index™ is Europe’s largest independent brand study focused on sustainability. The study is conducted yearly since 2011 from a consumer perspective (B2C) and since 2017 from a decision-maker perspective (B2B). The study has been conducted in the Netherlands since 2017.

For the Netherlands, this year’s SB Index™ reports the results for 176 brands across 14 different industries (based on the survey results involving 7.727 respondents).

In this article, I reflect on some of the key findings.

Key Findings

72% of respondents are discussing sustainability with friends and family (was 65% in 2019).

My take on this: Sustainability has gone mainstream. This relatively high number should not come as a surprise given the intensity with which issues such as climate change, deforestation, recycling etc. have been discussed in the popular press. Reinforcing this public narrative is the fact that brands themselves are more and more highlighting their own initiatives and achievements.

79% of respondents state that sustainability is affecting their purchasing decisions (was 77% in 2019). This percentage is the highest among all countries included in the ranking.

My take on this: Good news. However, this high percentage for the Netherlands is somewhat surprising given the evidence reported in other studies. For example “in one recent survey 65% said they want to buy purpose-driven brands that advocate sustainability, yet only about 26% actually do so” (White et al., 2019 (p. 127)). Is consumer behavior in the Netherlands that different from other parts of the world?

Alternatively, this relatively high number should not come as a surprise given that sustainability issues such as recycling, FSC-certification, CO2 reduction, biodegradeable packaging, … are almost omnipresent. Indeed, many of these sustainability issues are rapidly becoming table stakes. Indeed, it is almost impossible these days to NOT buy a sustainable product.

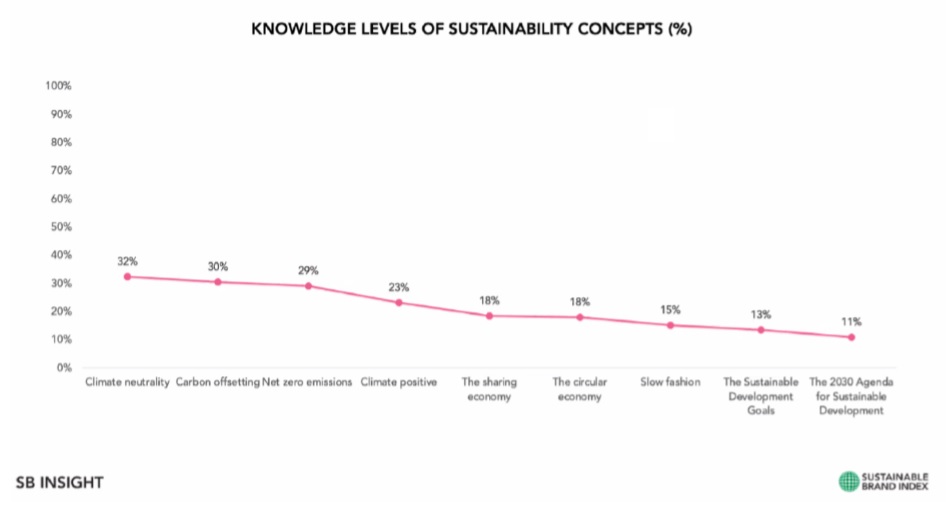

Importantly, knowledge levels of sustainability concepts remains very low! For example, only 18% of respondents felt knowledgeable about the concept of ‘circular economy’.

My take on this: The low sustainability knowledge scores suggest that respondents (consumers) lack the ability to process the sustainability messages of firms and therefore the ability to unambiguously discriminate between low and high sustainability performers. As a consequence, we need to be very careful in interpreting the results of the SB Index™. Indeed, previous research has demonstrated that significant differences exist between respondents’ perceptions of sustainability and a firm’s real investment in sustainability (Peloza et al. 2012). A high (low) SB Index™ ranking does not necessarily mean that a firm is, in reality, a high (low) sustainability performer.

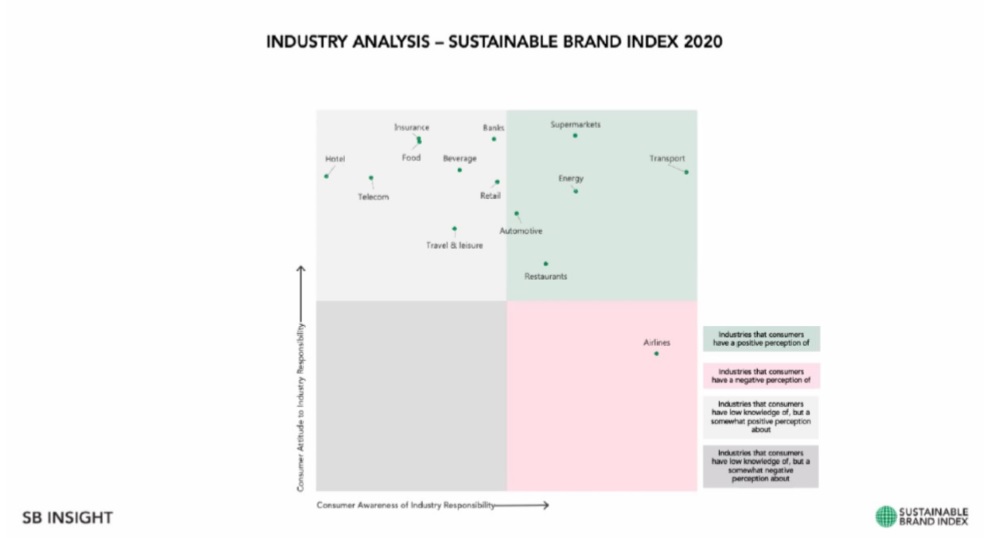

Significant differences exist across different industries. Not surprisingly perhaps, consumers continue to have a negative perception of the airline industry. Industries that consumers have a positive perception of include: energy, supermarkets and automotive.

My take on this: A consumer’s limited ability to process knowledge will trigger the use of decision-making heuristics. Essentially, a heuristic is a mental shortcut that reduces an individual’s cognitive complexity of making a decision. In the context of sustainability, industry bias is an important heuristic. Sector bias suggests that some industries (or product categories) suffer from a negative bias regardless of the real efforts of individual firms in that industry. The SB Index again documents the negative image of the airline industry. The emergence of terminology such as ‘flygskam’ (flight-shaming) not only documents but also reinforces this negative industry bias.

The top 3 sustainability aspects which respondents expect firms to prioritize are: recycling/reusing materials, sustainable packaging and workplace conditions.

My take on this: Don’t be too optimistic. These customer expectations are rapidly becoming hygiene factors. Some years ago, you could differentiate yourself on these attributes. Today, they have become threshold attributes. While having them may no longer give you an advantage, NOT having them will almost certainly become a competitive disadvantage.

For the third year in a row, Tony´s Chocolonely claims the title as most sustainable brand in The Netherlands 2020. Ahead of energy brand Greenchoice and mobility actor ANWB. Vattenfall climbs no less than 38 spots and with that enters the top 10 this year.

My take on this: Given a consumer’s limited ability to process all relevant knowledge about a firm’s real effort with respect to sustainability, consumers will rely on heuristics to inform theirattitudes and decisions. One such heuristic is brand bias (e.g. Fombrun & Shanley, 1990). A firm’s brand name will serve as a proxy for a consumer’s interpretation about the firm’s sustainability effort. While many brands will be perceived as neutral, individuals will typically have an inherently positive or negative attitude toward specific brands. Brand bias most likely contributes to the stability of the various category leaders in the SB Index™ including Tony’s Chocolonely number 1 position for three consecutive years.

On the other end of the ranking, low-cost airlines Ryanair (last at rank 176) and easyJet are perceived as not very sustainable. Other brands having a tough time this year, dropping the most, are Shell (-63), Schiphol (-56). KLM finds itself somewhere in the middle at rank 81.

My take on this: The Ryanair ranking (176) is most likely the result of a negative brand bias. The relatively low positions of Shell, Schiphol and KLM probably reveal a negative sector bias. In the case of KLM, the ranking does not seem to do justice to the company’s significant investments in sustainability (AirFrance-KLM Sustainability Report 2018 (2019)).

Concluding thoughts

Rankings such as those reported in the SB Index™ are based on perceptions. Understanding the informational mediums from which consumers construct their image representations of firms is necessary in order to correctly interpret the perceptional rankings.

But perhaps the more interesting question is the following: ‘Do Rankings Matter?’ Does a high ranking in the Index™ confer upon the firm an advantage in terms of increased customer loyalty, increased employee motivation, improved access to talent, lower operating costs etc.?

Rankings are not the end. They are a means to an end. They may be an important source of competitive advantage.

References

Fombrun, C & M. Shanley (1990), What’s in a Name? Reputation Building and Corporate Strategy, Academy of Management Journal, Vol 33, No. 2, pp. 233-258.

Peloza, J., M. Loock, J. Cerruti & M. Muyot (2012), Sustainability: How Stakeholder Perceptions Differ from Corporate Reality, California Management Review, Vol. 55, No. 1, pp. 74-97.

White, K., D.J. Hardisty & R. Habib (2019), The Elusive Green Consumer, Harvard Business Review, Vol 97, No. 4, pp. 124-133.

:quality(90))