What are the different ways my organization can generate income? TIAS professor of Strategic Leadership Ron Meyer presents an insightful tool to kickstart your thinking: Revenue Model Framework.

Key Definitions

All organizations need money to function and therefore require means to generate sufficient income. An organization’s revenue model is the specific manner by which it acquires these funds – it is the way that the organization gets paid.

In a typical company, the implicit standard approach is that revenue comes from selling products or services to customers, who directly pay the list price in cash. Yet, besides this ‘default revenue model’ there are many different ways of generating income.

Conceptual Model

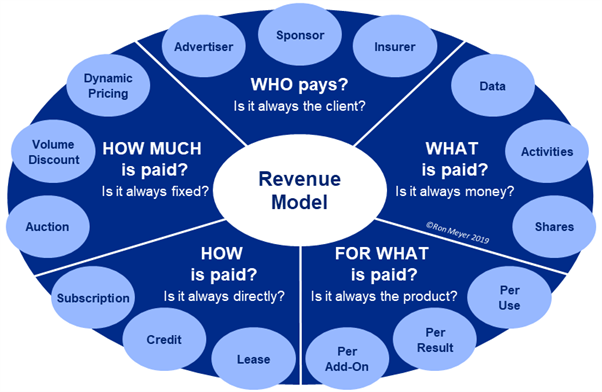

The revenue model framework outlines the five categories of choices that together make up a revenue model. Each category is formulated as a question around payment, with three common examples mentioned of alternatives to the default option. Each set of three examples is not exhaustive, so more possibilities exist in each of the five categories, but the categories themselves are exhaustive and all need to be addressed.

Key Elements

WHO pays? From whom does the money flow? Even if we say ‘the client’ it can be the case that it is not the actual user transferring the funds, but the user’s mother, or the budget holder or the procurement department. And looking beyond the actual client it could be a:

• Advertiser. Paying for the opportunity to promote something else.

• Sponsor. Paying to support something/someone unable to generate enough funds.

• Insurer. Paying out some risk covered by insurance.WHAT is paid? Can the client pay with something different than money? Since the time of bartering we have been used to exchanging goods for something different that financial tokens. Typical alternatives to monetary income include:

• Data. Paying by giving (personal) data to the supplier.

• Activities. Paying by performing (small) services for the supplier.

• Shares. Paying by giving a part of future revenue streams to the supplier.FOR WHAT is paid? What does the client get for the payment? Besides paying and receiving the product/service (pay per product), clients can also pay based on receiving some other benefit, such as paying:

• Per use. Paying only for the actual times or intensity of usage.

• Per result. Paying only for the outcome achieved.

• Per add-on. Paying only for the extras on top of the base product.HOW is paid? By what means does the payment take place? In the default situation, it is a straight-forward exchange, with ownership being acquired by paying the entire amount directly in full. But payment can also be by:

• Lease. Paying for exclusive use of a product for a certain period

• Credit. Paying for a product/service in instalments over a certain period of time.

• Subscription. Paying for access to a shared product/service for a certain period.HOW MUCH is paid? By what method is the price to be paid determine? Of course, everyone knows that in many situations the list price is just the first bid in a negotiation process. But besides fixed pricing and negotiations, prices can also be determined by:

• Auction. Paying the price set in a multi-party bidding process.

• Volume discount. Paying a price calculated by the volume of products purchased.

• Dynamic pricing. Paying a price calculated by time, place, demand and availability.

:quality(90))