A favorable energy label increases the transaction price and selling speed of privately owned homes. A study conducted by the TIAS School for Business and Society shows that 3,114 labeled home transactions found a buyer 85 days faster than transactions without the energy label. The effects of a green label (A or B category) are also reflected in the price.

Illustration: © Nationale Beeldbank

“It has become clear that buyers appreciate the information provided in the energy labels. When buying a new home, information is extremely important and the more information the seller provides, the faster the buyer can be convinced,” says Dr. Dirk Brounen, Professor of Real Estate Economics at TIAS and research coordinator for this analysis.

Every quarter, researchers in the TIAS Real Estate Lab study the performance of the energy label in the Dutch housing market. Figure 1, for example, shows that the current market share of 14.8% shows an upward trend compared to previous quarters. These labeled homes required 86 days less to arrive at a successful transaction.

2.2% price premium

The results of this energy label were also included in a price analysis of transactions by the NVM (Dutch Association of Estate Agents) for the third quarter of 2014. Among the 3,114 labeled transactions from the previous quarter, homes with a green A or B energy label had an average price premium of 2.2%, also when location and quality of the property were calculated for. Figure 4 shows that this 2.2% green label premium equals the long-term average and corresponds to a premium of more than €4,500 per transaction in the case of an average home.

This quarterly analysis is carried out by researchers in the Real Estate Lab at the TIAS School for Business and Society under the direction of Dr. Dirk Brounen. For this analysis, the researchers used transaction data from the NVM and energy label information from the Netherlands Enterprise Agency (Rijksdienst voor Ondernemend Nederland). The price effects are studied on a large scale on the basis of a validated research model as described in “On the economics of energy labels in the housing market” by Brounen and Kok and published in the Journal of Environmental Economics and Management 2011. This line of research into the effects of the energy label on the market for privately owned homes, is being continued by means of quarterly analyses.

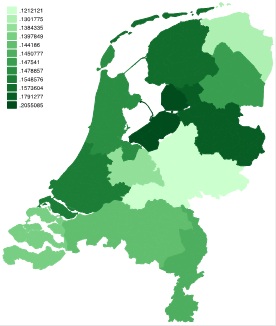

Figure 1:Market share of labeled transactions since 2008

Figure 2:Market share of energy labels for Q32014

Figure 3:Effect of green energy label on price

:quality(90))